Opportunity Zones are census tracts generally composed of economically distressed communities that qualify for the Opportunity Zone designation according to criteria outlined in 2017’s Tax Cuts and Jobs Act. Investors receive tax benefits comparable to a 1031 real estate exchange with the primary differentiator being that invested capital gains can come from any asset class. This incentive drives financial opportunity into communities that might otherwise be overlooked. Opportunity zones bring Wall Street Caliber investments to Main Street America.

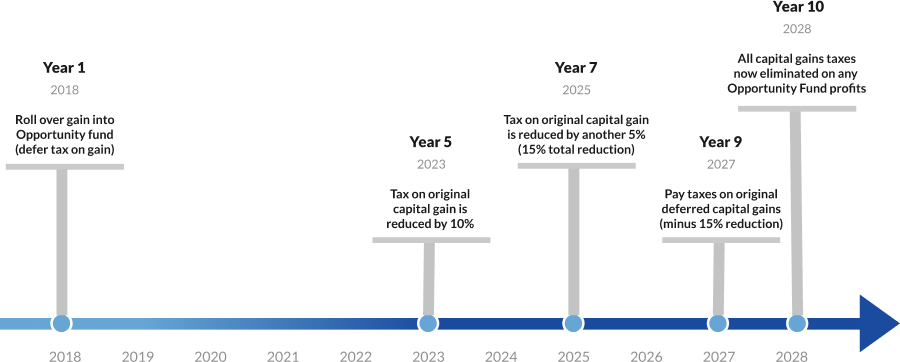

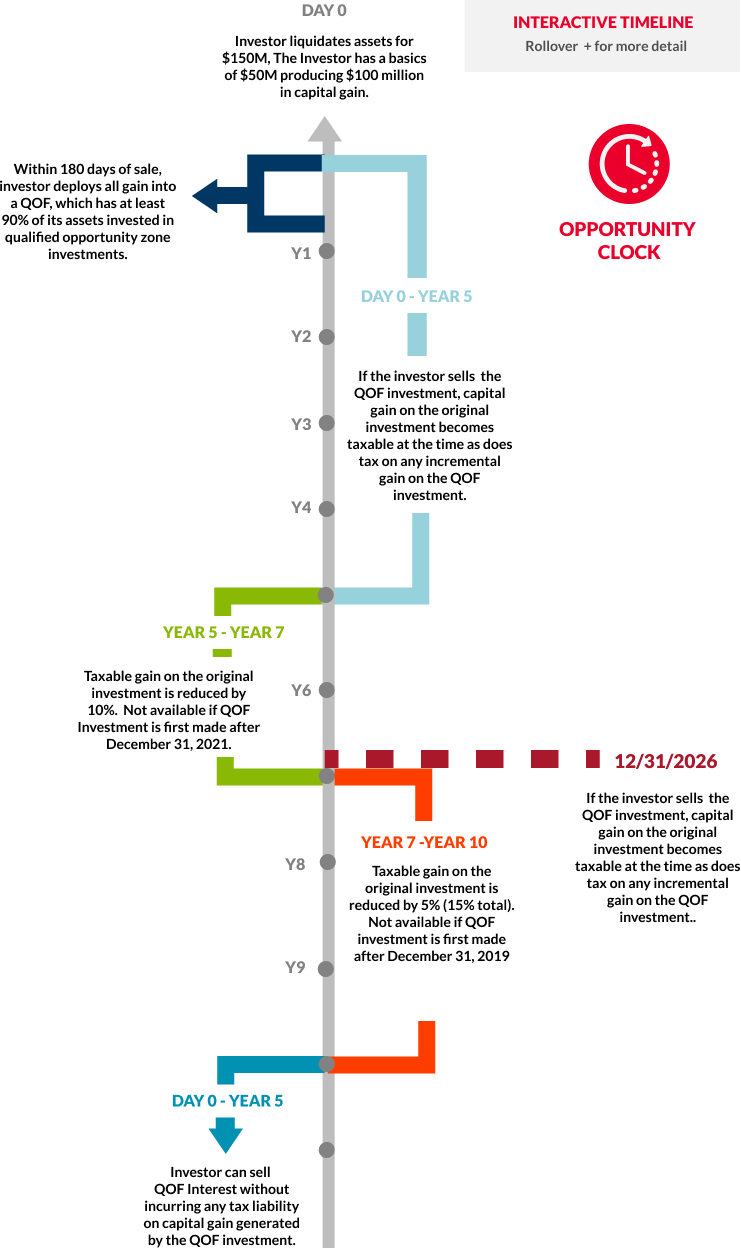

An investor who has a capital gain by selling an asset like stocks or real estate can receive tax benefits if they roll that gain into an Opportunity Zone Fund within 180 days. There are three advantages to rolling over your gains into an Opportunity Zone Fund:

Roll Capital Gain

Increase Basis

Tax Free Growth

*Reference Cushman & Wakefield Spotlight Timeline interactive graphic

If you have a $1M capital gain through stock, bond, business or property sale. Instead of

paying $238,000 in taxes,

you invest $1M

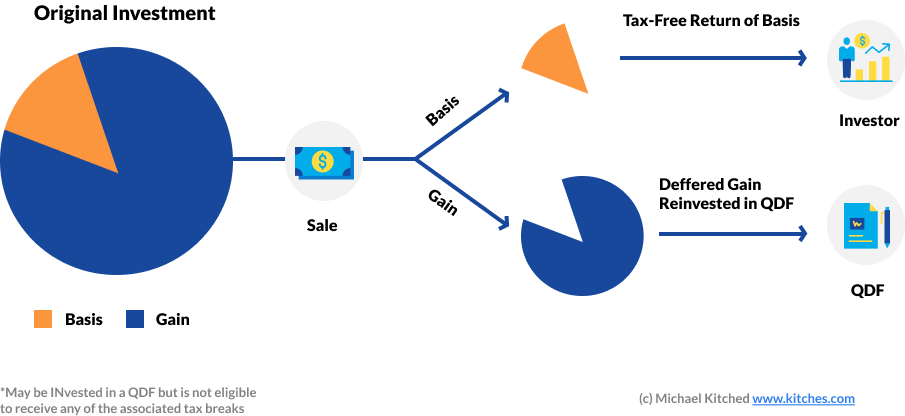

Splitting basis and gains using qualified opportunity funds.

into the Accredited Capital Tax Advantage Fund, an Opportunity Zone Fund that is focused on triple

bottom line returns. Let’s say in 2030, the Fund returns almost $2M including the original investment

considering 8% ROI. No taxes are due on the $1M gain. You'll only pay $202,300 in deferred capital gains on

first initial sale. Below is the comparison calculation that shows this scenarios

into the Accredited Capital Tax Advantage Fund, an Opportunity Zone Fund that is focused on triple

bottom line returns. Let’s say in 2030, the Fund returns almost $2M including the original investment

considering 8% ROI. No taxes are due on the $1M gain. You'll only pay $202,300 in deferred capital gains on

first initial sale. Below is the comparison calculation that shows this scenarios

| Initial Investment | |

| Capital Gains | 1,000,000 |

| Expected Annual Return | 8% |

| Capital Gains TaxRate | 23.8% |

| Initial Stock Investment after initial capital gains Tax | 762,000 |

| Initial Opportunity Zone Investment | 1,000,000 |

| 5 YEAR HOLD | |

| Stock Performance | 1,034,517 |

| Opportunity Zone Performance | 1,143,432 |

| 7 YEAR HOLD | |

| Stock Performance | 1,176,485 |

| Opportunity Zone Performance | 1,342,641 |

| 10 YEAR HOLD | |

| Stock Performance | 1,434,934 |

| Opportunity Zone Performance | 1,956,639 |

| Gain by Investing in Opportunity Zone for 10 years | 521,706 |

You can invest through a Qualified Opportunity Fund which provides a tax incentive for investors to re-invest unrealized capital gains, from any source, into a fund that is dedicated to making equity investments in businesses, real estate, and other business assets located in Opportunity Zones.

The Accredited Capital Tax Advantage Fund was created by a team of experienced real estate professionals, investors, technologists, and developers to professionally invest unrealized gains of investors into Opportunity Zones to generate triple bottom line - environmental, socioeconomic and financial. The fund will distribute capital to accelerate innovation in a way that positively affects a city's social impact. We are experts in managing our investments, executing real estate projects, and providing transparency through the process.

The driving force for the fund is to deliver top-tier financial returns for our investors (First Bottom Line), while working with communities to enable socioeconomic (Second Bottom Line), and environmental wins (Third Bottom Line).

We look for projects that are shovel ready and deals where capital can be deployed quickly and effortlessly.

Accredited Capitals main focus areas are single family housing, multi-family housing, shared living, and trailer parks. The focus is to minimize the risk of investment while maximizing the returns.

Accredited Capitals team values diversification by investing in different geographical areas to minimize risk.

Substantial alignment from operators, tenants, managers and investors safeguard our capital preservation approach.

The Accredited Capital team has substantial experience in real estate acquisitions, ownership and structured investments in the communities we focus in and have verified experienced local team members to work on projects.

We work very closely with clients who want custom solutions for the investment in terms of acquiring a particular asset

Accredited Capital has committed to measuring the impact of the social and economic metrics and has begun work on the OZ Rank rating system with a team that has experience managing over $1T in real estate.

Accredited Capital is administered by a team that includes a Managing Partner who is a licensed attorney and another who has an active series 7 license.

Please contact us with your details, amount you are interested in investing and any other information that would be helpful to understand your interest

One of our investment team members will get back to you shortly and discuss various options

Once confirmed the interest, we’ll send subscription documents to sign and get the invest check

We’ll put your investment to work, at this time our investors will receive a fully completed IRS Form 8949 in order to file to the appropriate tax authorities.

The Fund will deploy capital in our shovel-ready fully vetted projects and projects distributing cash flow via a preferred return expected within 180 days.